The hedge fund industry is undergoing a profound transformation as artificial intelligence (AI) reshapes risk management practices. Increasingly, hedge funds are leveraging AI-powered tools and analytics to identify, assess, and mitigate risks with a level of speed and precision that was previously unattainable.

The AI Advantage in Risk Management

Enhanced Data Processing and Pattern Recognition

Traditional risk management approaches are often outpaced by the complexity and speed of modern financial markets. AI excels at processing vast amounts of both structured and unstructured data, enabling hedge funds to analyze historical market data, financial statements, news, social sentiment, and economic reports simultaneously. This comprehensive analysis uncovers patterns and signals that human analysts might miss, allowing for more informed and timely decision-making.

AI-driven pattern recognition is especially valuable for detecting subtle market trends, irregular trading volumes, and anomalies in complex datasets. These insights help hedge funds anticipate market shifts and identify potential risks before they escalate.

Predictive Analytics and Real-Time Risk Assessment

AI-powered predictive analytics mark a shift from reactive to proactive risk management. Unlike traditional systems that rely solely on historical data, AI models continuously analyze real-time information to forecast market movements and potential risks. This enables hedge funds to respond to volatility and global events with unprecedented speed and accuracy.

The ability to anticipate risks earlier and respond faster can be the difference between a significant loss and a well-managed portfolio. AI-driven systems can flag increasing correlations, market stress, or emerging risks days ahead of manual processes.

Automated Risk Monitoring and Compliance

Routine risk management tasks, such as generating risk reports, monitoring compliance, and conducting portfolio assessments, have been revolutionized by AI-driven automation. These systems reduce manual workload, ensure greater consistency, and minimize human errors. Automated compliance monitoring also helps hedge funds adhere to regulatory requirements, flagging potential issues before they become costly problems.

Performance Impact and Quantifiable Benefits

Superior Investment Returns

Hedge funds that integrate AI into their risk management processes often see improved investment returns. AI-driven strategies can identify undervalued and overvalued assets with greater precision, optimize portfolio compositions, and adapt dynamically to market conditions. This leads to higher returns and a measurable competitive advantage over funds that rely solely on traditional methods.

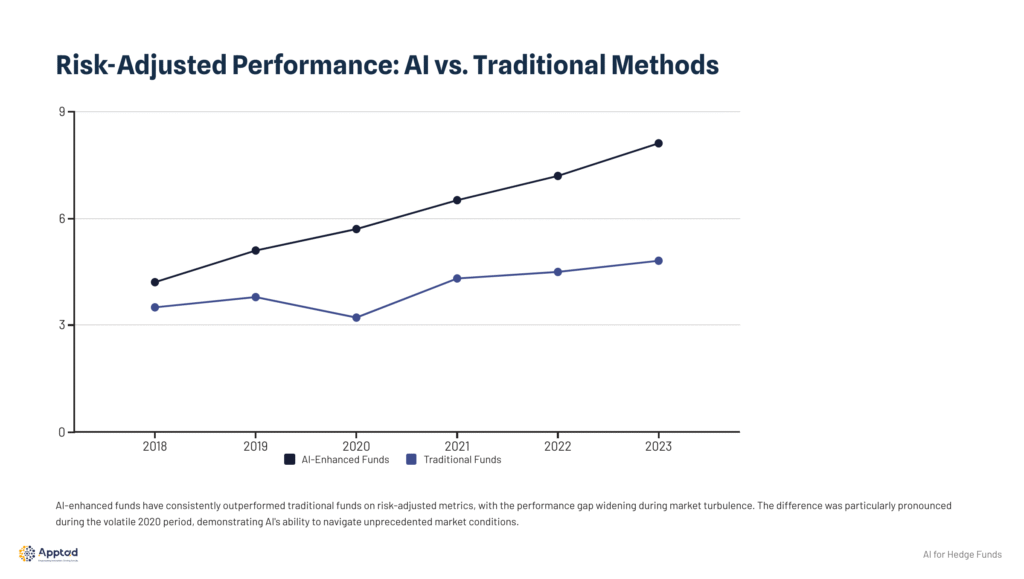

Risk-Adjusted Performance Enhancement

AI not only boosts raw returns but also enhances risk-adjusted performance. By running dynamic stress tests and scenario analyses in real time, AI systems provide deeper insights into portfolio vulnerabilities. This enables more sophisticated risk modeling and better management of volatility, helping funds maintain performance even in turbulent markets.

Implementation Challenges and Solutions

Data Quality and Algorithmic Bias

The effectiveness of AI in risk mitigation depends on the quality of the data used to train its models. Inaccurate or incomplete data can lead to flawed predictions and costly mistakes. Additionally, AI algorithms can inherit biases from their training data, potentially skewing risk assessments or investment decisions.

Cost and Complexity Considerations

Implementing advanced AI systems requires significant investment in technology, infrastructure, and skilled personnel. Ongoing maintenance, model updates, and hardware upgrades add to the complexity and cost. Hedge funds must carefully weigh these factors when planning AI adoption.

Regulatory and Transparency Concerns

The regulatory environment for AI in hedge funds is still evolving. Transparency and accountability are critical, especially when AI systems make decisions that impact large sums of capital. The so-called "black box" problem—where AI decision-making processes are difficult to interpret—poses challenges for both compliance and investor confidence.

Strategic Solutions and Best Practices

Robust Data Governance and Model Validation

Successful AI implementation starts with strong data governance to ensure clean, reliable data. Regular audits and diverse training datasets help minimize bias and improve decision accuracy. Comprehensive model validation, including backtesting and stress testing, is essential to maintain the integrity of AI-driven systems.

Hybrid Approaches and Human Oversight

The most effective hedge funds combine AI capabilities with human expertise. While AI excels at data processing and pattern recognition, human judgment adds qualitative insights and market intuition. A hybrid approach leverages the strengths of both, ensuring that strategic decisions are well-informed and balanced.

Incremental Implementation and Risk Management

Rather than adopting AI wholesale, leading funds implement AI solutions incrementally, focusing on specific use cases with clear value. This allows for better risk management, cost control, and gradual development of internal expertise. Cloud-based solutions and partnerships with specialized providers can help streamline the process.

Future Outlook and Emerging Trends

Generative AI and Advanced Applications

The future of AI in hedge fund risk management includes the adoption of generative AI, which can create synthetic financial data, develop trading signals, and optimize portfolios in innovative ways. These advanced applications are expected to play a growing role in investment decision-making.

Integration with Alternative Data Sources

Hedge funds are increasingly turning to alternative data sources—such as satellite imagery, social media sentiment, and IoT data—to gain unique market insights. AI systems are particularly adept at processing and analyzing these diverse data streams, further enhancing risk mitigation strategies.

Autonomous Trading Systems and Market Evolution

The industry is moving toward more autonomous AI-driven trading systems capable of executing complex strategies with minimal human intervention. Balancing this autonomy with robust risk controls and regulatory compliance will be key to maintaining stability and investor trust.

Conclusion: The Imperative for AI Adoption

AI integration in hedge fund risk management is not just a technological upgrade—it’s a strategic imperative. The benefits are clear: improved returns, enhanced risk-adjusted performance, and faster, more accurate decision-making. However, successful adoption requires careful attention to data quality, regulatory compliance, and the balance between automation and human oversight.

As AI continues to evolve, the hedge funds that master its integration will define the future of investment management. Those that fail to adapt risk being left behind in an increasingly AI-driven financial landscape. The revolution in hedge fund risk management is underway, and the time to embrace AI is now.